Deadline for Making Disclosures to Revenue in Relation to Determining the Status of Workers

Final Reminder: 30th January 2026

Deadline for Making Disclosures to Revenue in Relation to Determining the Status of Workers

We refer to previous correspondence to you regarding the above, in particular:

- Our circular dated 21st January 2025 on the tax issues arising from the Supreme Court case Click Here

- Our circular dated 14th October 2025 on the opportunity to disclose any tax issues to Revenue (and the benefits of doing so) Click Here

The deadline for making disclosures to Revenue is 30th January, i.e., in two weeks’ time.

We would advise that you look at payments made to service providers who engaged with your business from 1 January 2024 and compare them to the examples in the disclosure.

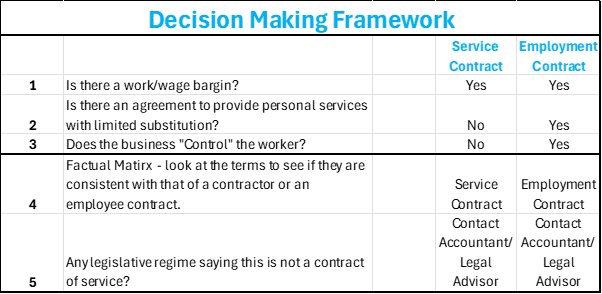

Please follow the Decision-Making Framework and contact us to make the necessary disclosure by 26th January, where applicable. Please note that if questions 1 to 3 below are answered in the negative, then there is no need to continue on.

As always, please contact us where you need assistance.